The Inside Scoop on Medicare Advantage

Right now, we are in the middle of what is called Open Enrollment. I thought it would be a good time to go over MA plans and why they are terrible

Hello! So it’s now 3 days until we have the giant diaper baby in office at the time of this writing.

One of his cabinet picks, Dr Oz, absolutely loves Medicare Advantage Plans. He loves them because they make him a metric fuckton of money.

So, what is a Medicare Advantage Plan? Basically, it’s Medicare, with similar regulations around aspects of care, with the Medicare allowed rates for services, with a couple of bells and whistles. They also include Dental and Vision, which is not covered by traditional Medicare. They also offer extra services, like extra cash for groceries and rent, OBC allowances, and transport. Sounds like a great deal! Almost too good to be true! Well. You may be wondering what the catch is.

See, there are a massive amount of drawbacks to a plan like this, because your care is now at the mercy of an industry that made $371 billion dollars in profit in 2024. They made those profits by killing about 68,000 people a year by denying healthcare to vulnerable populations.

And don’t let their cute little slogans like “Healthier Happens Together” or our CVS “Heart at Work” shit fool you. It’s lies. If you read my very first newsletter, you know how they chain their call center workers to a desk for 8 hours a day. The title, by the way, is a saying used all of the time by employees like myself, because it’s completely true.

And this is not even unique to Aetna. They are all like that. Stroll over to Reddit and find the employee subs for any of these insurers. It’s horrifying.

I listen to every Town Hall or read the transcript. A few months ago, when Brian Kane, CFO and someone who thinks a tin $.02 pin is an adequate Christmas bonus, said in a town hall, “Medicare will bring us $75 billion, and that is a public number” He was sacked shortly after, by the way.

So. How do they do this?

Denying claims

This is the biggest one, and the one that got the most attention. I’m sure 99 percent of you reading this have had this issue in one way or another. Claim denial is different than a prior authorization. This happens AFTER a procedure is completed.

So, say for example you’re going to a doctor, and they order a test. They send in the claim with the CPT code. A person, usually someone who has been contracted overseas, looks at the claim and uses the CPT code and diagnostic code to determine if the procedure was “medically necessary” Now, the second part of that is super important.

Here’s an example. Your doctor wants you to have a specific procedure for something you’ve been diagnosed with. It’s not always used in this circumstance, but its unconventional use here has proven effective. He sends the bill including the diagnostic code to the insurer. The insurer has a list of diagnostic codes that they will “allow” for this procedure. Any other use, and they will deny it flat out. So. Now you get a bill for hundreds of dollars. And it doesn’t matter if it is effective and helps you. It doesn’t matter if it’s a common thing used. If that diagnostic code is not on the list, you can expect a bill.

There are other sneaky ways that they will either deny or charge you as well. For example, most Medicare plans are only effective within a certain area. Unlike traditional Medicare, you are locked in. If you need to see a doctor on vacation, you are shit out of luck. And god help you if you have an emergency. They’ll pay “if they determine it was an emergency”. So they may deny you. These narrow networks apply to everything: Your ambulance, your anesthesiologist. You could take an out-of-network ambulance to an in-network hospital and be stuck with a huge bill. Then you either have to file an appeal, which may or may not work and takes forever if they don’t lose the paperwork, or it’s sent to the correct department. Right now all major insurers are using AI, leading to a surge of these denials.

And this is after you have your procedure. So now you’re stuck with a surprise bill.

Prior Authorization

This is the second way. So, you know your insurance, you read up on your policy. Your doctor says you need an MRI. You and your doctor go over everything. The doctor then needs to send a prior authorization to the insurer. And then they receive a letter in the mail 3 weeks later that the procedure is denied. So, they can appeal, which will take another 3 weeks. And on and on. There are other steps to take after the initial appeal: You can go all the way to the courthouse. But if you’re sick, do you also want to go through all of this? Do you even have the energy? Do you have people who will call on your behalf 4 times a week?

So, what do you do? Well, your options are take out a loan or credit card to pay, or you don’t get the procedure.

And not only do you need to worry about your insurer. You also have to worry about the various vendors. MRIs and vision at Aetna, for example, are handled by two different vendors. The extra benefit debit card is handled by a separate vendor. The OTC benefits are handled by yet another vendor. And usually, calling the insurance company isn’t going to do shit because we don’t know anything about their process. And the vendor for MRIs in particular, Evicore, is contracted specifically to deny you care. Most insurance companies contract with them.

Not only that, but in our golden age of technology, an AI will most likely be deciding your fate, or a doctor who is not even in the correct specialty. They will use every single trick in the book. Those CPBs I mentioned? They are also called utilization management and are a guideline on how the company is going to try to deny you. Too bad you can’t get your live-saving drugs, but here’s some rent assistance I guess.

Networks

Now, with commercial insurance, you are not limited to a geographic location. (as far as I am aware, though I bet they want to change that). But with an MA or MAPD plan, you are limited to a small network inside of a specific geographic marker such as a set of area codes. Take a step out of that, and you’re instantly deemed out-of-network and are on the hook.

Now, a lot of people who are retired go to different places (snowbirds for example) and live there for a time. If you are lucky, you may have travel benefits. But if not, then you’re out of luck. They say they will cover emergency situations, but we know from above how that will most likely go. So, your network is severely limited. And when large networks decide to stop taking your insurance, you now lose access to your doctors. Unless you’re willing to fork over the cash, of course.

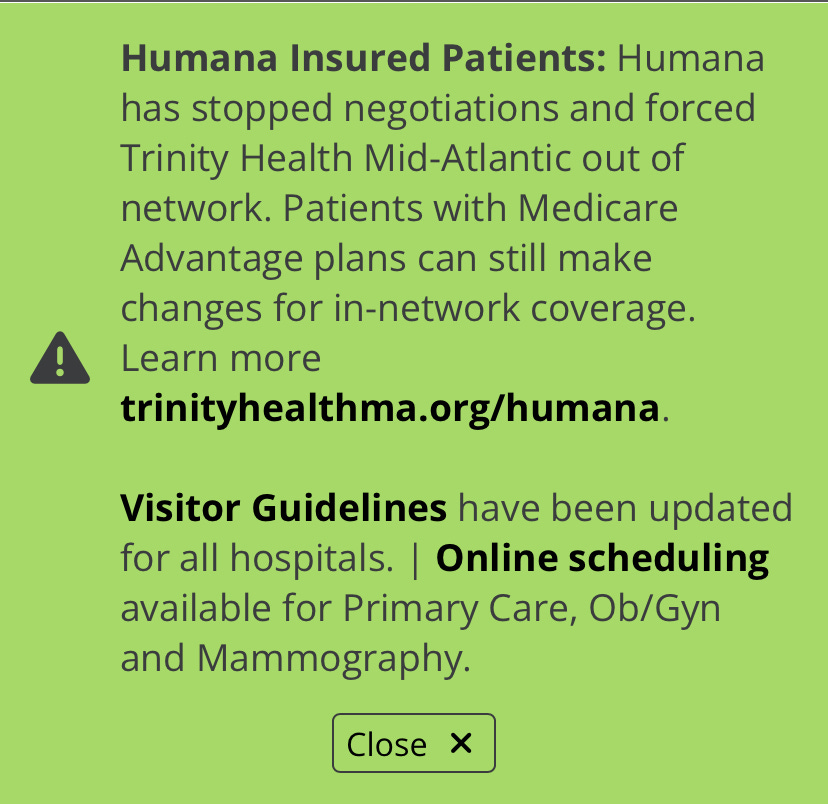

Here is an actual screenshot of an announcement from Trinity Health saying they will no longer accept Humana.

Step Therapy and Drug Tiers

Now, this is right up there with prior authorizations for outright evil. This is from a pro-health insurance website:

If a health plan uses step therapy for certain drugs, it means that a patient can be required to try a lower cost prescription drug that treats a given condition before “stepping up” to a similar-acting, but more expensive drug. The health plan won’t cover the more expensive drug until the lower-cost medication has failed to treat the patient’s condition. Other names for step therapy are “step protocol” and “fail first requirements.”

Step therapy is a very common cost-control strategy. Step therapy generally saves money for both the patient and the health plan.

Seems like it makes sense, right? Why would you try the expensive drug first?

Well, yes it saves money. But what does it mean for a drug to “fail” in real life terms?

I’ll tell you: It means you will get sicker until they decide you’re sick enough to warrant shelling out for the good shit. So if you have say, a thyroid condition and generic synthetics don’t work, you will have to live with those symptoms every day until your insurance company decides to write a check. And if you get new insurance? You now have to fight with them to get treatment that you and your doctor already know works all over again. Or of course, you pay out of pocket. Which does not touch your deductible at all. So now you’re paying them for jack shit. Here is an article about it. You can find many more like it. And the thing is, step therapy, when used correctly, can absolutely be beneficial. But when insurance companies see a way to cut costs, they don’t care about the proper way. They ram the policies through with only one thought: This will make us money. And that money comes at the expense of your health.

So. What can you do?

First thing is obvious. Do not fall for their lies and get a Medicare Advantage plan. You can get supplemental insurance and a Medigap plan to cover anything Medicare does not. My in-laws have one, and I’ve never heard them say a word about fighting with their insurance company. It is absolutely imperative that you are clear with what you want, as they will try to upsell you on all of the bells and whistles. Like I said, they sound appealing, but they come at a hidden cost that will not make itself known until you are at your most vulnerable. And believe me, even if you think the benefits are great now, those generous benefits come at a cost (to the company) and they will absolutely be changed at any time to suit their greed.

Please take a minute to read this article in full. I’m going to post the important bit here, though. Emphasis added.

When we priced Medicare Advantage plans for 2024, we underestimated medical costs," said Joyner. "Rich benefits exacerbated utilization pressures and grew membership rapidly. There were also some disappointing risk adjustment updates which significantly burdened Aetna's current results. This performance is unacceptable."

Due in part to Aetna's performance, CVS Health officials said they were not providing a formal outlook, though Joyner said he was optimistic about the segment's recovery prospects, particularly with the announcement that Steve Nelson, a former UnitedHealth Group insurance leader, to run Aetna.

So, I bolded those two points because they go together. Now, I didn’t understand the significance of the second point until… December 4th. The first one is a bunch of industry jargon bullshit. To break it down: We covered everyone’s healthcare too much and it hurt our bottom line. That’s it. It means they did the right thing and it lost them money, so now they’re going to fuck everyone over harder. Which is where the second one comes in. I’m sure you noticed where Mr. Nelson was formerly employed.

Now, I didn’t have a clue about that until the shooting. But something tells me he was brought on to do what Brian Thompson did for United. Now, I don’t have any of the stats from when Nelson was with UHC, and this is already a doozy of an article. But the implication is pretty apparent now. So please, avoid these like the plague. Oh and by the way, from that same article:

Despite the performance, CVS Health Chief Financial Officer Tom Cowhey said revenues in the health benefits segment increased 25%, with medical membership growing to 271 million

Emphasis added*

So, they still made bank. But it’s not enough.

Now, if you are already in a MA or MAPD plan, there are things you can do. During this period of time, Open Enrollment or OEP, you can drop your medicare advantage plan outright. If your plan hasn’t taken effect yet, you can simply call the insurance company and do what’s called a verbal cancellation. You just tell them you want to cancel your coverage, and just like that, they have to do so. It’s the best way if you realized how terrible these people are and are done.

Now, if the plan is in effect, that is a different scenario. You will have to send a letter of disenrollment to the insurance company. All of the forms can be found on the website, or you can just write them a letter telling them to politely fuck off and cancel the plan. Then the plan will be deactivated at the end of the month, putting you back into Original Medicare. Now, and I have seen this with my own eyes, people who have been signed up for an MA plan without their knowledge.

Here is an article from 2016 reporting on a lawsuit regarding this practice. Please, if you are on Medicare, triple check with CMS to make sure you are covered by Medicare as soon as possible.

Here is a pamphlet from CMS about what to do if you are enrolled without your knowledge. Also, please bear in mind that during AEP (October 15th to December 7th) you will get many, many calls from these companies trying to recruit you. Just say no thanks, tell them to put you on the Do Not Call list, and hang up. The amount of times I’ve seen people enrolled without knowing is too damn high.

Second thing you can do is complain to Medicare. CMTs are a HUGE deal. They affect what’s known as the STAR rating, and these can make or break a Medicare plan. If they lose a star, like Aetna did in 2023-2024, they lose business.

Here is a breakdown of what goes into a Star rating. Unfortunately, a similar thing doesn’t exist for commercial, where you will see a lot more issues. While MAPD and MA plans are horrible, there is no recourse like this for those with commercial insurance. So, this is a huge deal.

If you and your loved ones are in an MAPD plan, and are having trouble getting the care you need, you should not even bother with calling the insurance company. They will file a grievance and it will go nowhere. Reach out directly to CMS. Here is the link to the CMS complaint form. So if you are fighting for care, complain directly to Medicare. And by the way, employees are discouraged from speaking about this. Most people don’t know this is a thing. So please, if you take nothing else from this article, please share that complaint form everywhere. Blast it so people know they have options.

Remember, the only thing they want is your money.

So, take it back. Don’t give them an inch, as over half of eligible Americans are enrolled in one of these plans. So, tune in and drop out of your Medicare advantage plan. Let’s see these numbers drop significantly. Let’s reject these rich assholes in 2025.

If you don’t want to commit, please consider buying me a coffee. Every little bit helps.

I took my brother in law’s advice when I retired and got his regular Medicare instead of Advantage. I not sick very often but finally I thought I should get a primary care physician. So I checked the Medicare website which had tons of doctors/clinics listed. After contacting at least 10 providers I was so disgusted. The receptionists told me, “we are not accepting Medicare currently.” They didn’t ask whether it was as regular Medicare or Advantage so that is not the issue. I have checked back every few months and get the same answer. Any suggestions would be much appreciated. Thanks

This morning in the State of RI, 2 lawmakers, Democrats, are trying to pass a law to stop insurance companies from forcing PC doctors to have referrals that insurance companies deny.

In this state there's a shortage of PC. What person would want to raise their family in a state that has a shortage of PC Drs and the Dr spends more time fighting for referrals than serving the right care to their patients. If this goes into law, it won't be until July 2026. So many people will die before then but RI lucky if they can pass it🙏