Explain it Like I'm 5: Premium, Copay, Coinsurance, Deductible, Max-Out-Of-Pocket.

These terms can trip people up. Here is what they mean and how to estimate cost.

Hello! I hope you are all doing well in the hellscape we now call America. It’s uh… Worse than I thought. Anyway, here is some non-political, useful information that can help you navigate your shitty insurance!

Premiums

This doesn’t need a lot of explanation, but it still needs to be noted overall, as this will not only effect your healthcare costs initially, but overall as well. It’s also important to include this in regards specifically to HRA/HSA plans. Those plans have a lower overall premium but usually have a much higher deductible.

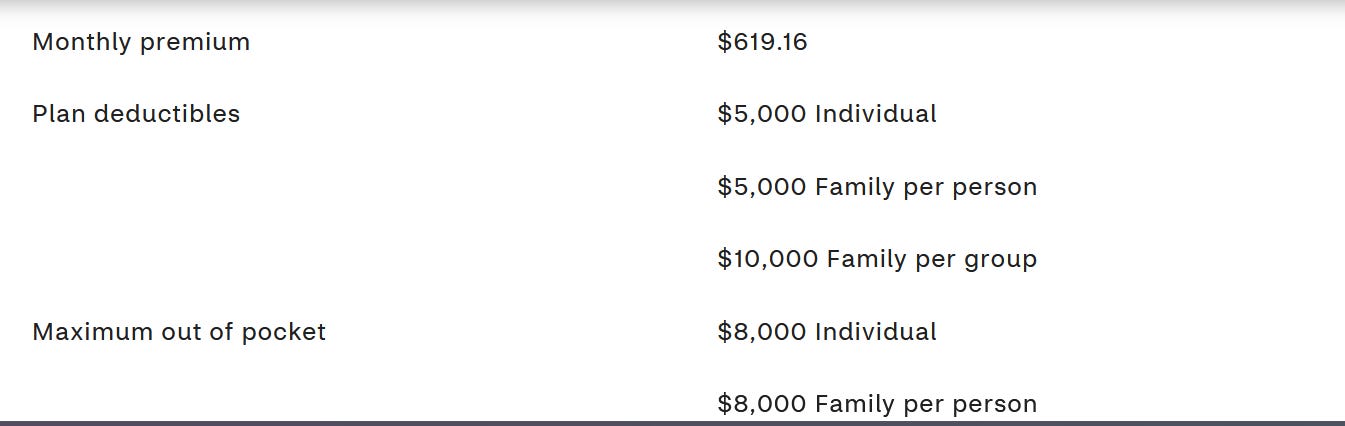

Like anything in this capitalistic nightmare world, the more expensive the plan is, it usually means that it covers “more”(which of course obviously depends on if you jump through hoops to get things approved). I am attempting to find more information on employer-provided healthcare, but those are typically bespoke, and the insurance sales team helps add things that the employer wants. So it all depends on what the place you’re working at has signed with the company. So, all of these examples will use ACA plans. Here is an example from Atlanta. Our fake person here just got married, they are not adding their spouse or dependent. Their household makes $75000 a year. Here is the lowest premium plan:

So, remember how I said you get what you pay for? Keep in mind the other terms that I mentioned:

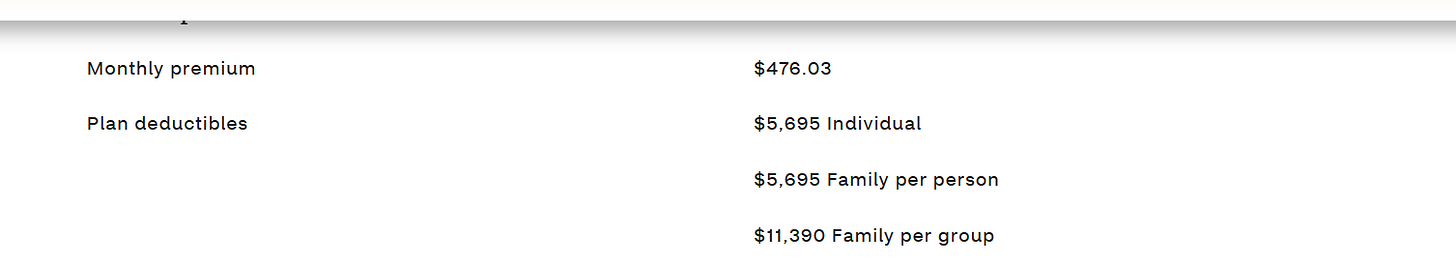

Here are a few more examples:

So, you should by now be noticing a pattern. The more expensive the plan, the less you have to pay up front per services. And by the way, that last one looks cheap, but it ONLY covers medical. No dental, no vision. So you’re now paying both of those things out of pocket along with the premium for this plan, and the services, because they are not free. Moving on!

Deductible:

By far the most insidious creation by our for-profit healthcare system, this is the amount of money you have to spend BEFORE your insurance covers anything. So, say you have to go to the doctor’s office for something. That visit costs around $250, but you have a 7500 deductible. You’re paying that entire amount. And that sounds like a random number, but it’s not. That’s about what I just paid to see a specialist because I have a $2000 deductible. And remember, I fucking work there. That deductible is “low” (yet it’s more than half my income for the month, but whatever). So I paid them about $120 a month, and still have to pay out of pocket until I meet that. But at least my prescriptions are covered. Which is not always the case…

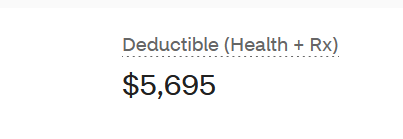

Notice how that says Health + RX? That means that all of your shit is out of pocket until you meet the threshold. Then, in this plan, you get the pleasure of paying %50 on top of that AFTER you meet the deductible.

So, now, until you meet the out-of-pocket-max, you’re still on the hook for hundreds of dollars, which I will get to a little later on.

Now, these places can offer HSA or Health Savings Account (Where you pay into a savings account to use on healthcare per month, which can be use-it-or-lose-it, or if you get insurance through an employer, they may offer a HRA, or Health Reimbursement Account (Where your employer provides a certain amount towards your medical expenses) Both of these things are kind of a joke. Aetna used to offer $100 every three months, though now it’s a little better. HSAs come out of your pocket, so that depends entirely on your income as to what you can save for this. If I’m being very honest, and as someone who was on Aetna’s shitty off-brand insurance, this really doesn’t do jack shit. I had an HSA and it still took me years to pay off a 2018 emergency room visit. This is the bread and butter of how health insurance companies make money, or “balances the cost of healthcare”. You pay them, and they don’t pay anything until you hit that max out of pocket. And there are different rules for every type of plan, and between family and individual. To make it extra confusing. Here is another super helpful link about deductibles that goes more in-depth than the scope of this article, and you should definitely take a look into it.

There is allegedly a cap on deductibles, but while writing, I couldn’t find the exact legislation, and also, at that point, does it really matter if there is a cap if the allowed deductible is unaffordable in the first place? Not really. Most people and families won’t reach the deductible unless there is a catastrophic need. Here are some of those numbers again.

So, how many of you, who consider yourself healthy, have spent over 5k a year on healthcare? I know I have once, for an ER visit. It was over 2 grand with insurance. I drained my HSA, which had about $700 in it. Then I received a SECOND bill for another $1700 which I had to put on a payment plan. Because the physicians had a separate bill, of course. In the last 3 years, I have never even been close to hitting that deductible. And again, my plan is less shitty (still shitty though) so I get the services I use most covered. But if say, if you take maintenance medication, you’re paying out of pocket, with the rest of your medical care. So you’re paying the insurance company and then for your medical.

COINSURANCE:

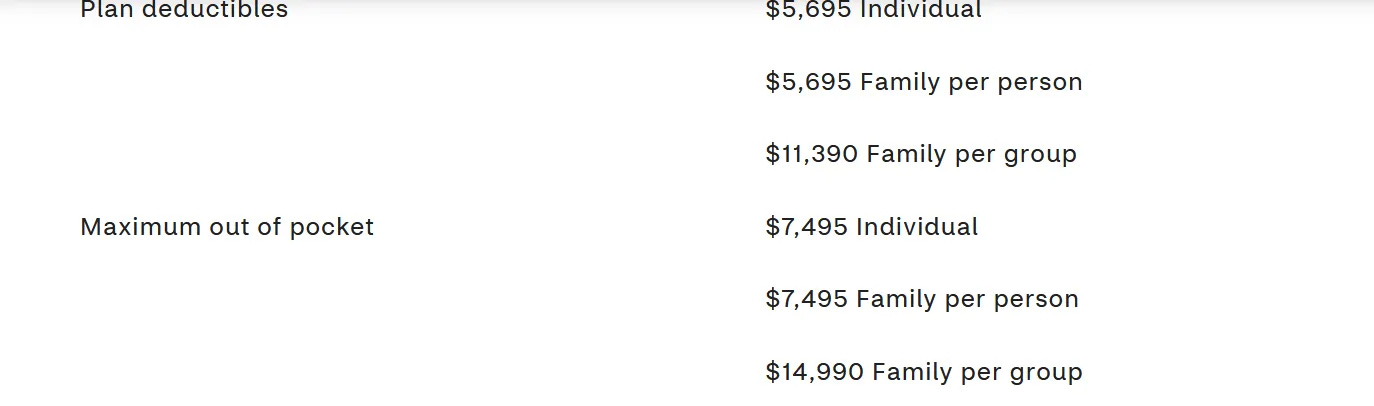

This is what people usually get confused with copay. Coinsurance is you pay AFTER you meet the deductible. I can also be called “cost share”, because that’s what you’re doing. To save the insurance company money- er “Lower healthcare costs”, of course. So, taking a look at one of the plans again:

So, almost 6K until the plan will pay for anything. Then:

So now you’re paying 50% out of pocket even though you just paid almost $6K. And this is until you hit the max-out-of-pocket:

Again, this depends on the plan and how much both the deductible and your coinsurance will be. And of course you’ll only know how much the total is after you get your bill. This is not a COPAY. A copay is something you pay prior to service, such as when you go to a doctor, where they usually have you pay a certain amount up front. From what I’ve seen, you won’t have both, but under certain circumstances, you may have separate copay/coinsurance for services, such as an office visit with labs or X-ray. The rules on things like that will be in a different article down the road. Here is another in-depth look at coinsurance.

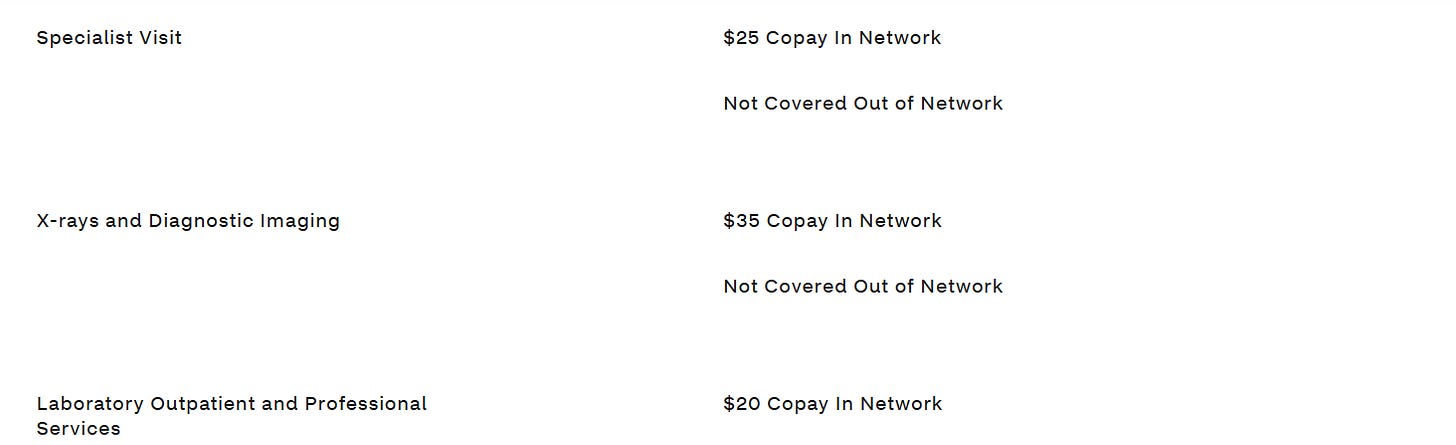

Copay:

So, here is Copay. You still have a max out of pocket but the costs for this are more predictable, as they are a flat amount. They’re still incredibly high for certain procedures, and also depend on the overall plan that you have. Usually, these plans are incredibly expensive, so you’re likely going to be stuck with a deductible plan as opposed to a plan with just a copay. Again, once you hit the insane max-out-of-pocket, these will be covered by your insurance. Some plans also have a mix of copay for some services and coinsurance for others, so it can get confusing. Just remember, a copay will be a flat dollar amount, and a coinsurance will be a percentage. Here is another helpful website about copay.

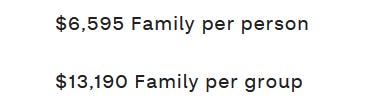

Max-Out-OF-Pocket:

This is pretty much exactly what it sounds.

Once you hit this, the insurance will pay for all of the rest of your expenses, so your deductible, copay, and coinsurance will be taken care of by the insurance company, sort of. This usually will not apply to anything Out of network, or denied. So if you have a procedure, and you’ve met your out-of-pocket, and the insurance denies the procedure, you’ll still have to pay that. So this only counts toward in-network, unless you have specific provisions in your plan. And even those will not always count towards any sort of denials. So just make sure you’re paying attention to your EOB, which will give you this information.

Here is another helpful link.

Anyway, here is the information to help figure out your costs, hopefully before you get a surprise bill. Thank you for reading!